The Free Market Portfolio Theory is the synthesis of three academic principles: Efficient Market Hypothesis, Modern Portfolio Theory, and the Three-Factor Model. Together these concepts form a powerful, disciplined and diversified approach to investing. The result is globally diversified portfolios including over 12,000 stocks spread across more than forty countries, designed and engineered to capture market rates of return.

Efficient Market Hypothesis

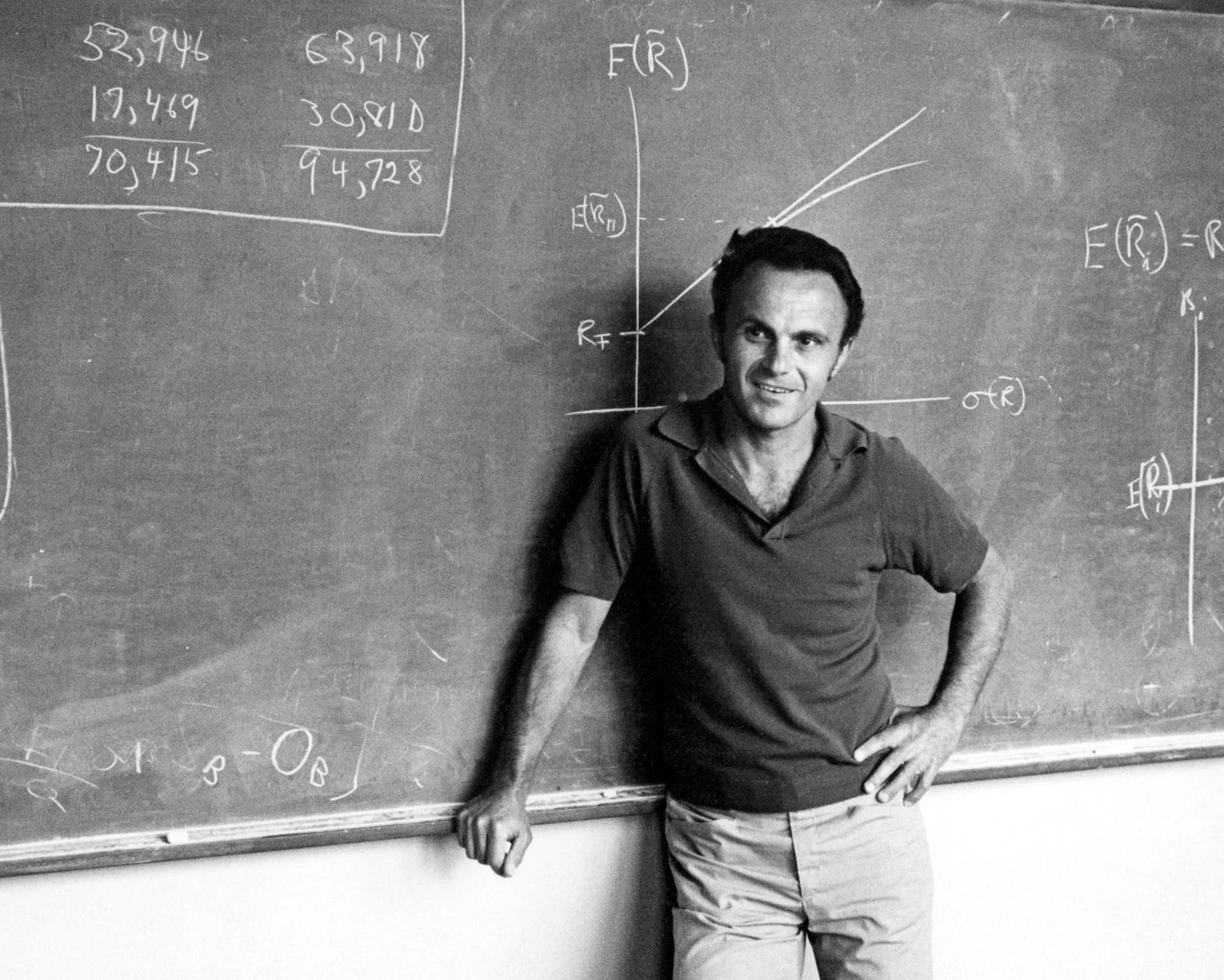

Eugene Fama - The Sveriges Riksbank Nobel Prize in Economic Sciences 2013

A fundamental component of Free Market Investing is the Efficient Market Hypothesis, first explained by Eugene F. Fama in his 1965 doctoral thesis:

"In an efficient market, at any point in time, the actual price of a security will be a good estimate of its intrinsic value."

- Eugene F. Fama

The stock market, the media, and popular culture encourage behavior consistent with the belief that the market is inefficient. You must understand that there is a choice to be made about how you believe the market works. We focus on capturing market returns utilizing asset-class or structured funds, diversifying prudently, and eliminating stock picking, track record investing and market timing from the investment process.

Source: Markowitz, Harry. "Portfolio Selection". Journal of Finance, 1952

Modern Portfolio Theory

Harry Markowitz, Merton Miller and William Sharpe - Nobel Prize in Economics 1990

The second basic component of Free Market Portfolio Theory is Modern Portfolio Theory (MPT), which earned the Nobel Prize in Economics in 1990 for the collaborative work of Harry Markowitz, Merton Miller and William Sharpe.

Essentially, MPT demonstrates that for the same amount of risk, diversification can increase returns. The task is to find assets with an academically proven risk premium and low correlations. The Efficient Frontier allows individuals to maximize expected returns for any level of volatility.

Source: Malkiel, Burton. "A Random Walk Down Wall Street". 1973

Fama, Eugene; French, Kenneth. "The Cross-Section of Expected Stock Returns". Journal of Finance, 1992

The Three-Factor Model

Eugene Fama and Kenneth French

Investing is uncertain. Until recently, much of investing involved guessing what really matters in returns. In 1991 this changed. Eugene F. Fama and Kenneth French, two leading economists, conducted an investigation into the sources of risk and return. Grounded in Efficient Market Hypothesis (EMH), their research revealed that a portfolio’s exposure to three simple but diverse risk factors determines the vast majority of investment results. These three factors are referred to as the Three-Factor Model:

The Market Factor

the extra risk of stocks vs. fixed incomeThe Size Effect

the extra risk of small-cap stocks over large-cap stocksThe Value Effect

the extra risk of high book-to-market (BtM) over low BtM stocks

Source: Fama, Eugene. "Random Walks in Stock Market Prices". Financial Analysts Journal, September/October 1965.